Mar 15, 2024

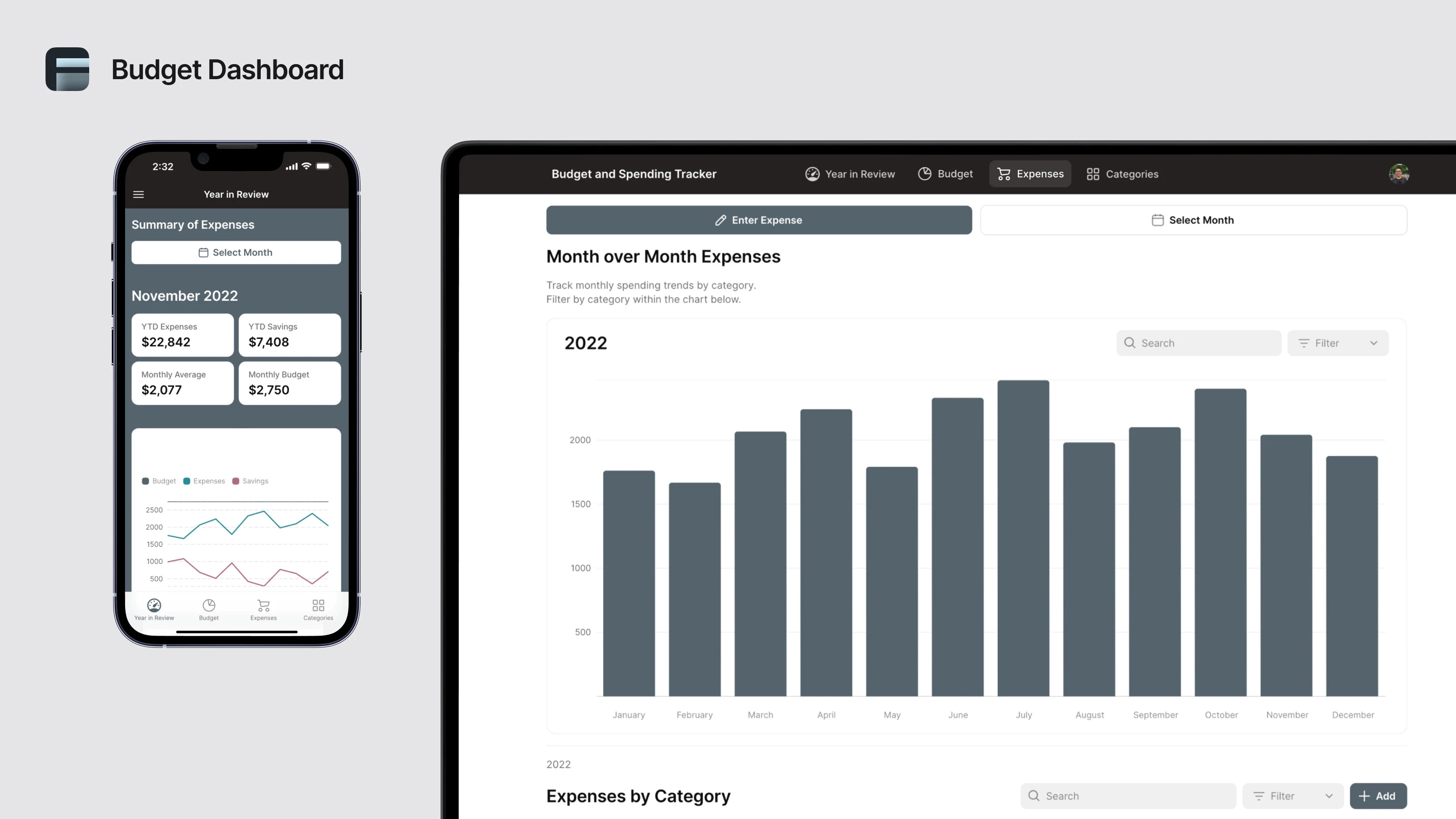

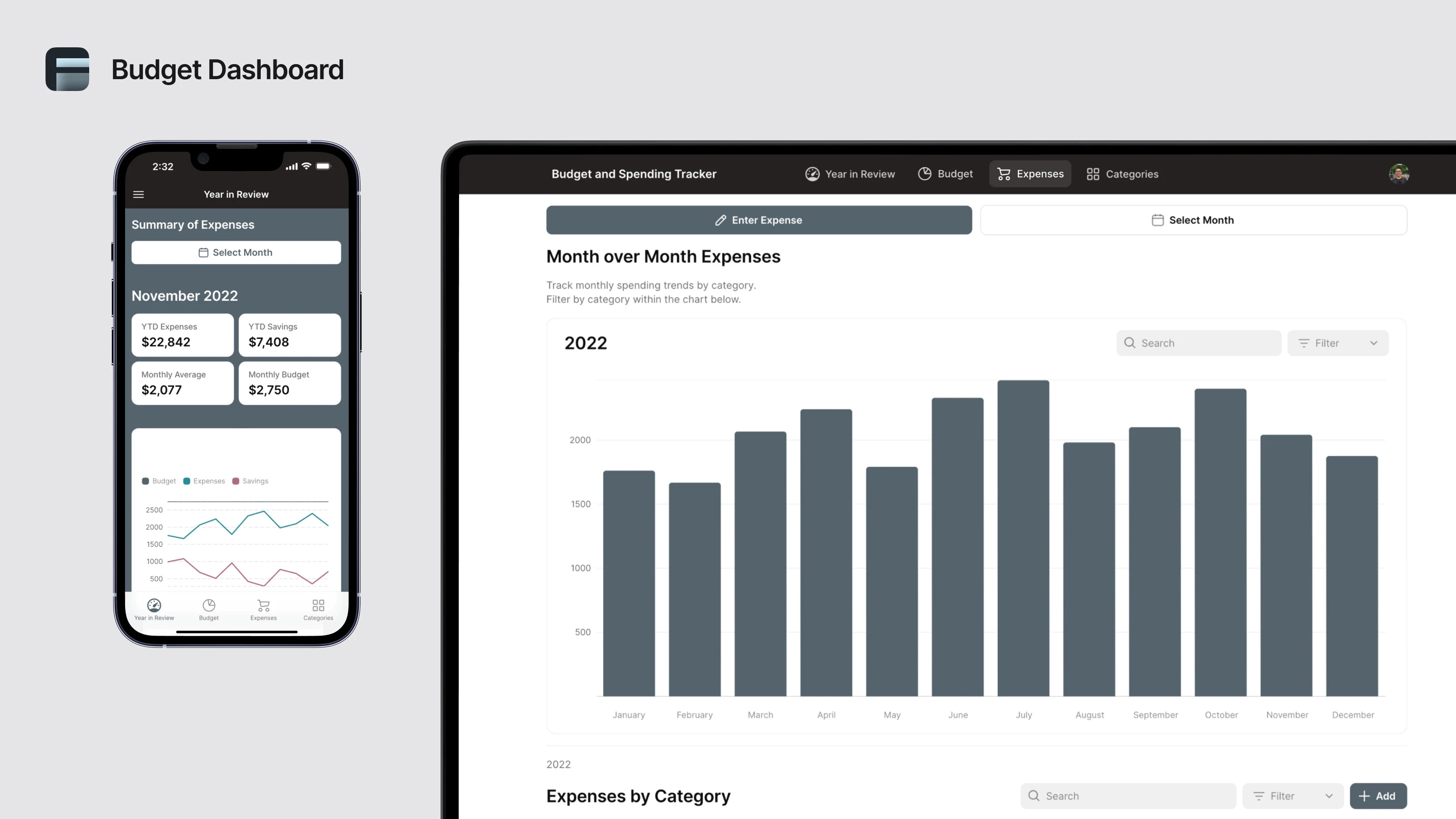

Enhancing Financial Management with a Budget Dashboard App

Real-Time Financial Tracking

A budget dashboard app allows users to monitor their income, expenses, and overall financial health in real-time. This immediate access helps in making informed financial decisions quickly.

Customizable Views and Reports

Users can tailor the dashboard to display the most relevant financial data. Customizable charts and reports provide clear insights into spending patterns and financial trends, making it easier to stay on top of budgets.

Automated Data Syncing

The app can automatically sync with bank accounts and other financial tools, ensuring that all financial data is up-to-date without manual entry. This automation reduces errors and saves time.

Goal Setting and Alerts

Users can set financial goals and receive alerts when they are close to reaching their limits or if unusual spending occurs. These features promote better financial discipline and planning.

Example: Personal Finance Management

Consider a self-employed individual who wants to save for a vacation. A budget dashboard app can track savings, categorize expenses, across all channels, and provide insights on where to cut back, helping to achieve the financial goal faster.

Conclusion

A budget dashboard app offers real-time tracking, customizable views, automated data syncing, and goal setting, enhancing financial management efficiency and accuracy. Implementing such an app can lead to better financial health and informed decision-making.

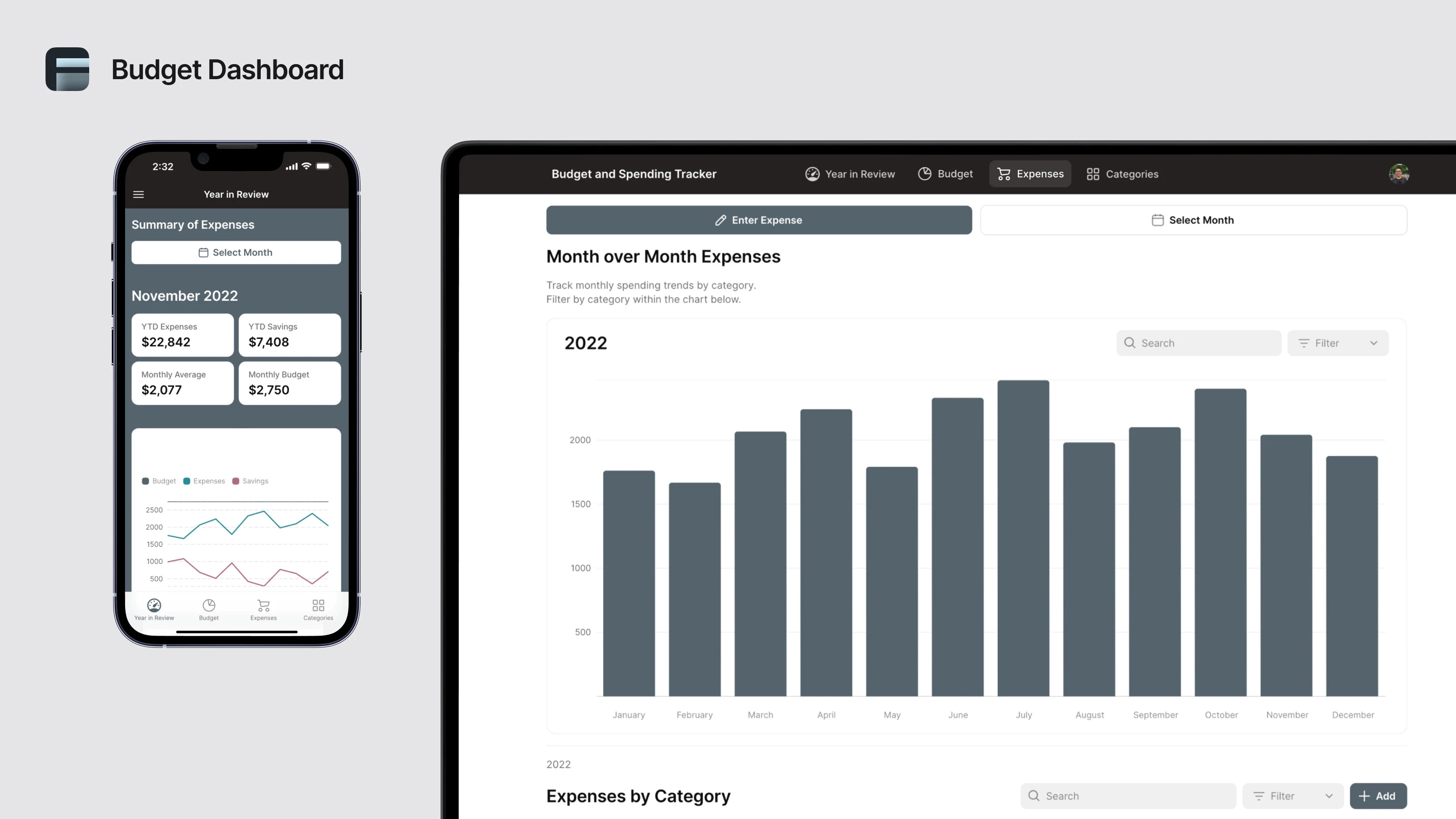

Real-Time Financial Tracking

A budget dashboard app allows users to monitor their income, expenses, and overall financial health in real-time. This immediate access helps in making informed financial decisions quickly.

Customizable Views and Reports

Users can tailor the dashboard to display the most relevant financial data. Customizable charts and reports provide clear insights into spending patterns and financial trends, making it easier to stay on top of budgets.

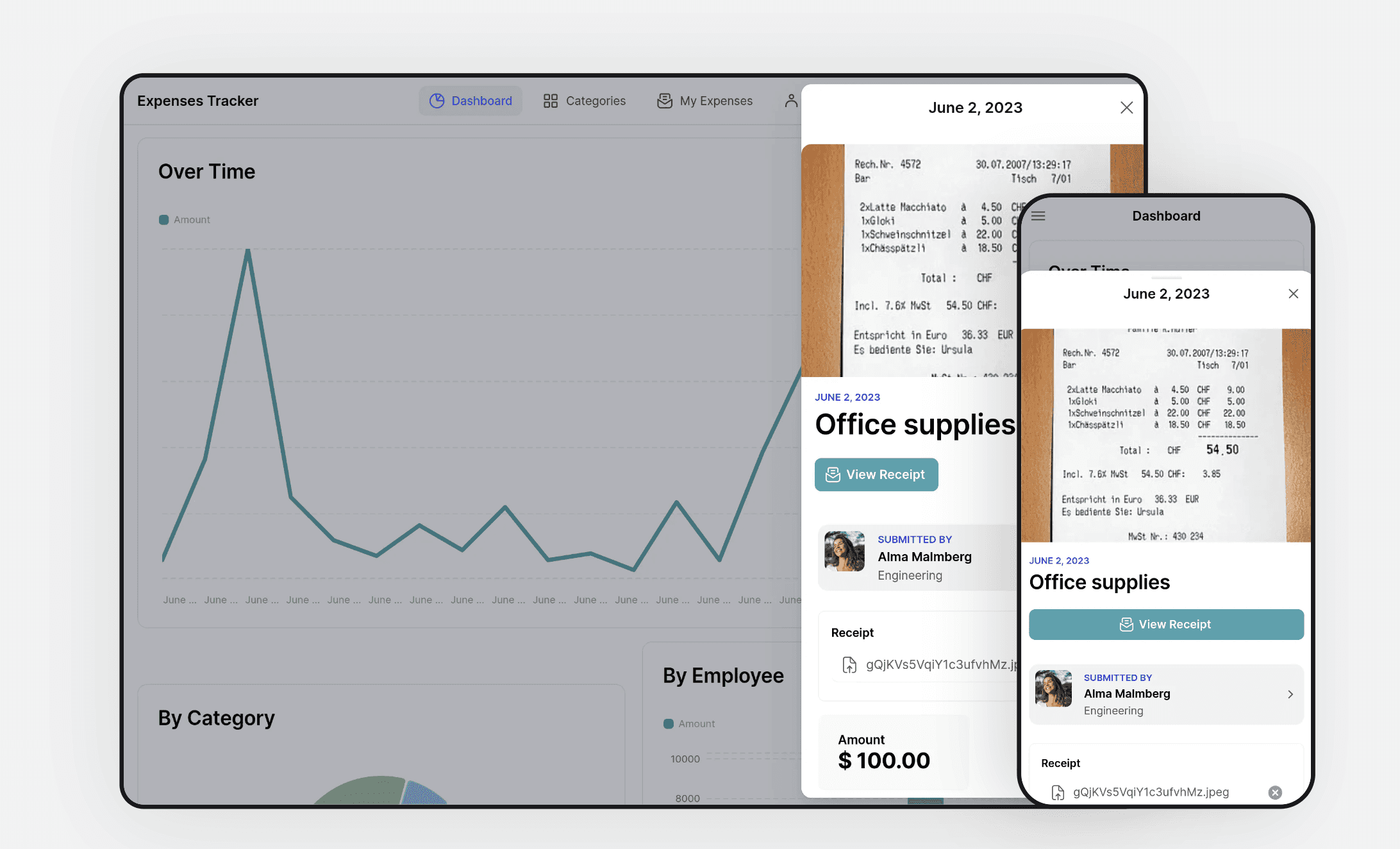

Automated Data Syncing

The app can automatically sync with bank accounts and other financial tools, ensuring that all financial data is up-to-date without manual entry. This automation reduces errors and saves time.

Goal Setting and Alerts

Users can set financial goals and receive alerts when they are close to reaching their limits or if unusual spending occurs. These features promote better financial discipline and planning.

Example: Personal Finance Management

Consider a self-employed individual who wants to save for a vacation. A budget dashboard app can track savings, categorize expenses, across all channels, and provide insights on where to cut back, helping to achieve the financial goal faster.

Conclusion

A budget dashboard app offers real-time tracking, customizable views, automated data syncing, and goal setting, enhancing financial management efficiency and accuracy. Implementing such an app can lead to better financial health and informed decision-making.

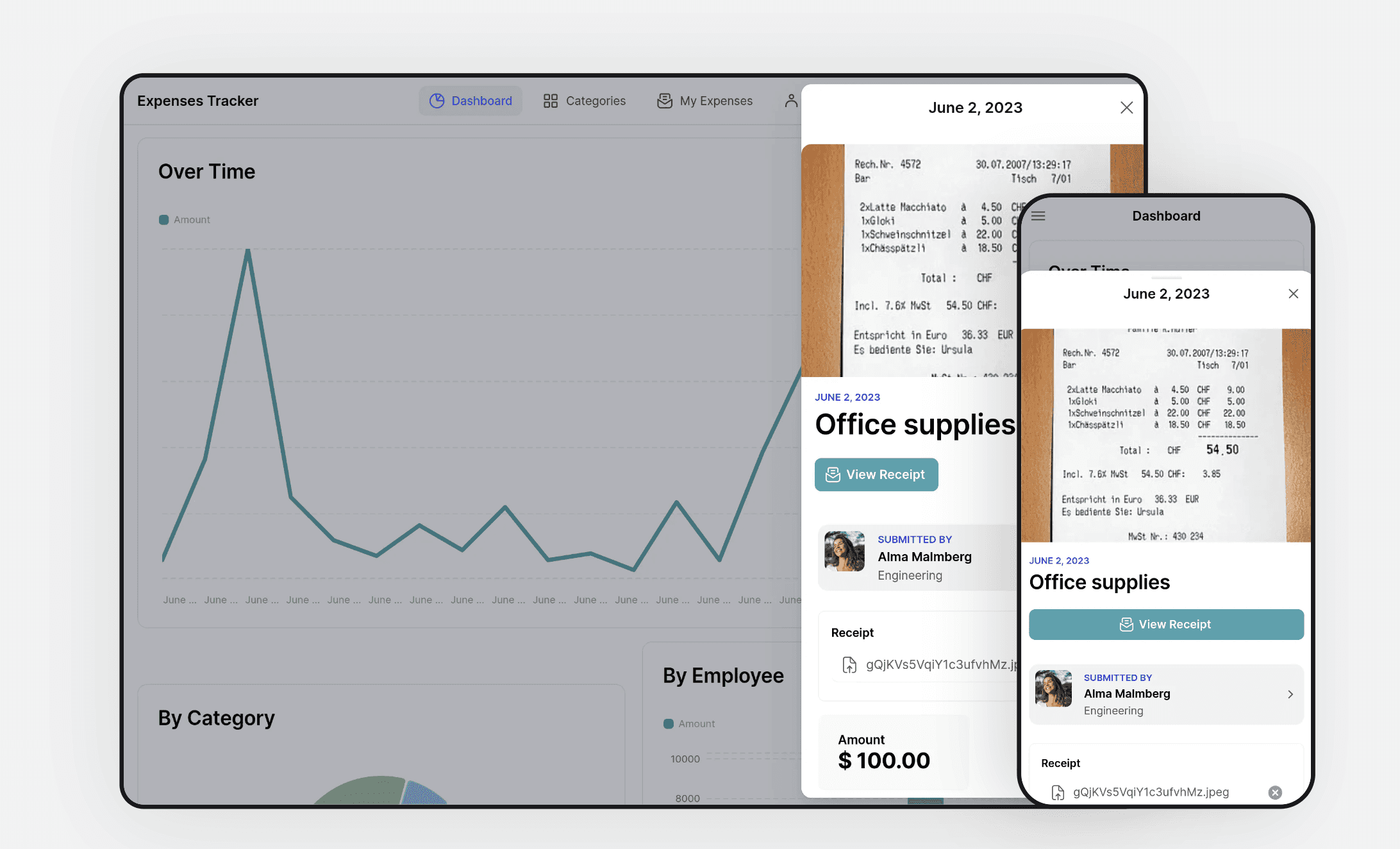

Real-Time Financial Tracking

A budget dashboard app allows users to monitor their income, expenses, and overall financial health in real-time. This immediate access helps in making informed financial decisions quickly.

Customizable Views and Reports

Users can tailor the dashboard to display the most relevant financial data. Customizable charts and reports provide clear insights into spending patterns and financial trends, making it easier to stay on top of budgets.

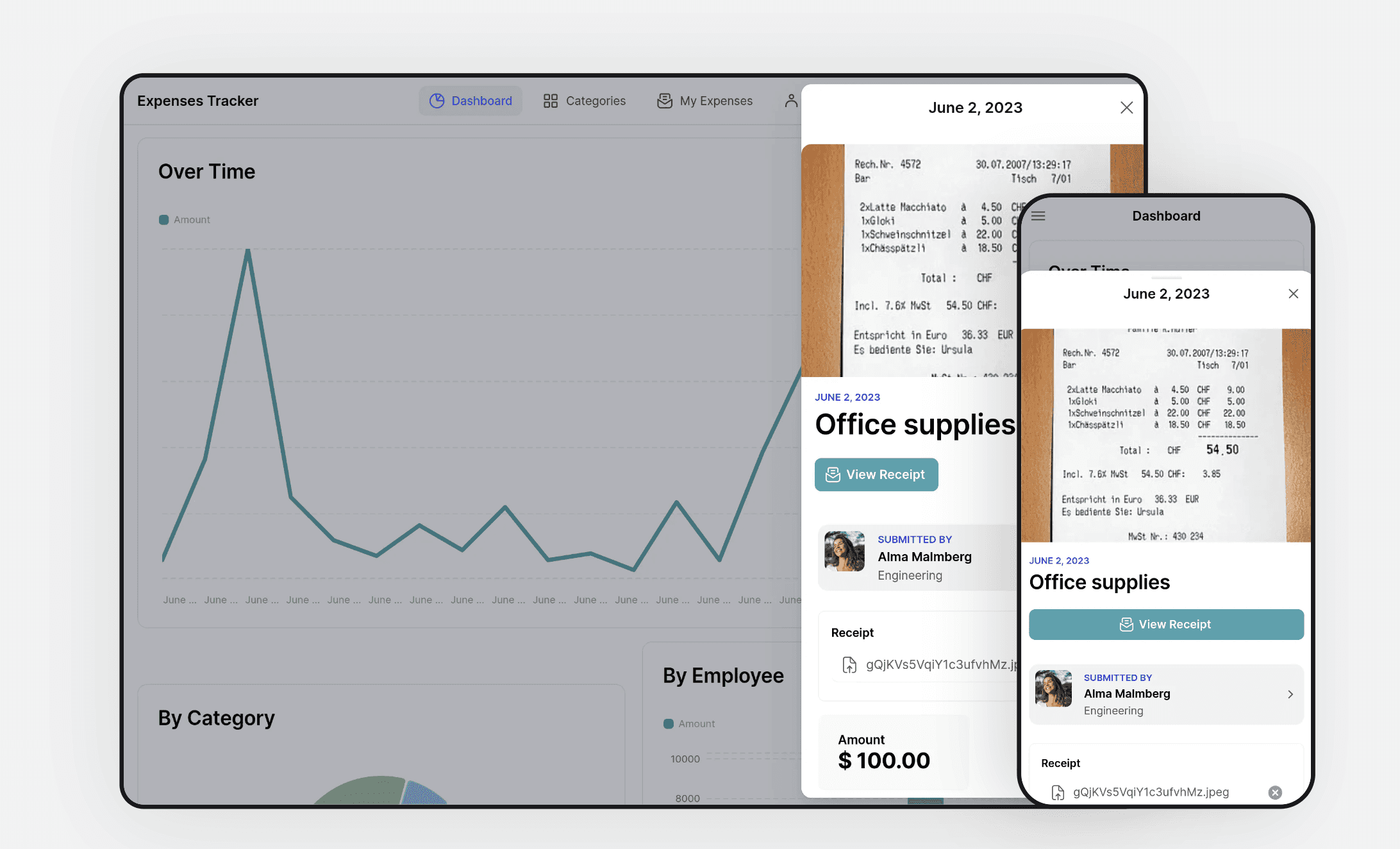

Automated Data Syncing

The app can automatically sync with bank accounts and other financial tools, ensuring that all financial data is up-to-date without manual entry. This automation reduces errors and saves time.

Goal Setting and Alerts

Users can set financial goals and receive alerts when they are close to reaching their limits or if unusual spending occurs. These features promote better financial discipline and planning.

Example: Personal Finance Management

Consider a self-employed individual who wants to save for a vacation. A budget dashboard app can track savings, categorize expenses, across all channels, and provide insights on where to cut back, helping to achieve the financial goal faster.

Conclusion

A budget dashboard app offers real-time tracking, customizable views, automated data syncing, and goal setting, enhancing financial management efficiency and accuracy. Implementing such an app can lead to better financial health and informed decision-making.

Articles